Business Rates Relief

Overview

Business Rates (also known as National Non Domestic Rates), are a tax on business concerns and organisations that use a building, warehouse, shop, office or other such premise for business purposes.

The tax rate is set nationally by central government based on the rateable value of the property. The rateable value of business properties is adjusted, generally every 5 years, by the Valuation Office Agency (VOA) to reflect changes in the the property market. The most recent revaluation came into effect in England on 1 April 2017, based on a valuation date of 1 April 2015.

In his budget speech on 8 March 2017 the Chancellor announced that the Government would make available a discretionary fund of £300 million over four years from 2017-18 to support those businesses that face the steepest increase in their business rates as a result of the latest revaluation.

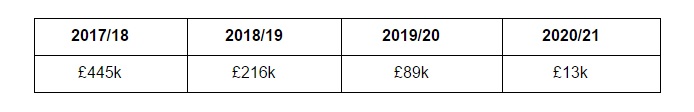

Funding will be distributed to local authorities to provide discretionary relief to target individual hard cases where bills have increased significantly following revaluation. Sutton’s allocation of funding is as follows:

In addition, the Chancellor announced a £1,000 business rate discount for public houses (pubs) with a rateable value of less than £100,000 for one year from 1 April 2017. Under the scheme eligible pubs will receive a £1,000 discount on their bill for 2017/18.

The purpose of this consultation is to ask your views about the London Borough of Sutton’s proposed local discretionary rate relief schemes as follows:

-

Revaluation - Local Discretionary Rate Relief Scheme 2017/18 and 2018/19

-

Public Houses (Pubs) - Rate Relief Scheme 2017/18

Areas

- Belmont

- Carshalton Central

- Cheam

- Stonecot

- Sutton Central

- Sutton North

- Sutton South

- The Wrythe

- Wallington North

- Wallington South

Audiences

- All residents

Interests

- Business

Share

Share on Twitter Share on Facebook